Backing Rillet

If you are the CFO of a high growth business that’s graduated to ARR in the $millions, the chances are that you are reviewing your accounting software. You’ve likely outgrown the functionality of a QuickBooks/Xero-type product and need to graduate to a more complex ERP. We believe roughly 200k US businesses a year go through this process. The default, ‘no one got fired for buying IBM’, option is currently NetSuite.

For 20+ years, NetSuite has played a key role underpinning the financial systems of large companies and, even now, for any enterprise with $100m+ in ARR who has spent many years and dollars in customizing it, it probably still serves their needs. But for the mid market, especially high growth companies with recurring revenues, it frankly sucks and is ripe for disruption.

NetSuite needs extensive customization, taking many months and requiring expensive consultants and integrators. No high growth business can afford to wait 6-9 months to get their accounting system up and running. It is also highly manual with high latency. The biggest problem, however, is that it does not unlock the potential of AI in finance. AI needs clean data and most NetSuite customers’ data syntax has been muddled by countless customizations from various 3rd party consultants.

So what does the next generation of ERP look like for high growth companies in a new world of AI? The answer (we think) is Rillet.

Rillet has built a beautiful, slick product that fully enables accounting automation, allowing for zero day close and freeing up accounting teams to focus on more strategic work. Rather than adding a layer on top of legacy systems (and even more complexity), Rillet has rebuilt the general ledger from the ground up.

Rillet integrates with payment processors, CRM tools and HR systems and makes sense of this raw data using metadata and AI to run all kinds of workflow automations that finance teams used to have to do manually — from invoicing to closing the books and running investor reporting. Rillet can even handle this automation across multiple entities, geographies, and currencies — turning a major pain point as companies scale internationally into a single view with a single login.

Nic and Stelios are the ideal candidates to build this. Intelligent, hard-working, product focused and obsessed with the mission. They have experienced first-hand the challenges of legacy ERP (Nic was the US CEO of neobank, N26). This is a product built by accountants for accountants and it is head and shoulders above anything else we’ve seen in this space so far. Over 70 customers with great feedback is a strong testament of that. We can’t wait to see where they take it.

Our investment thesis

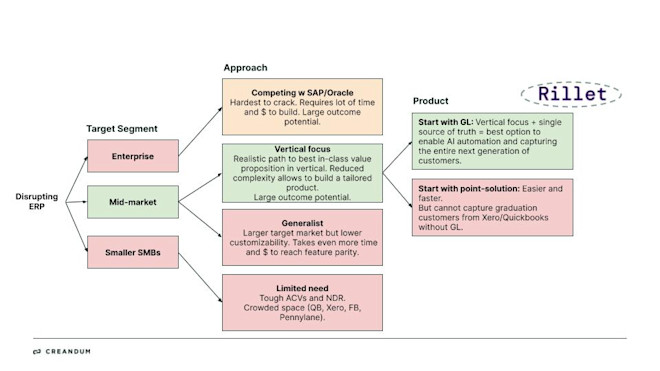

Investment memo chart - 'Why Rillet's approach is most effective for disrupting ERP'

Our starting point is that accounting software is ripe for disruption. Legacy solutions are decades old, offer a poor customer experience and will not allow finance teams to reap the benefits of AI.

But building a new accounting ERP is extremely complex. This is mission critical software for any business. At the Enterprise level, it is difficult to unwind customizations made over many years and for new players to achieve parity with the breadth of features incumbents offer. Whilst small businesses often don’t need the complex features of an ERP and are served by cheaper accounting and/or point solutions.

We think Rillet has the right approach because:

Mid-market, and particularly businesses graduating from QuickBooks/Xero, is the big opportunity.

Their initial focus is the US. Much bigger market and a fraction of the tax codes as the EU. Makes sense to start here and then target other geographies.

Vertical focus, starting with recurring-revenue businesses. Rillet’s product is tailored enough to deal with the complexity on the revenue side for these businesses. At the same time, this “niche”is large enough to build a decacorn.

It’s cracked the General Ledger problem. Most companies targeting this market start by building accounts payable or accounts receivable functionality but have shied away from building the actual General Ledger which is hard. Rillet has gone straight to the General Ledger so it can instantly become the single source of truth for customers.

It can unlock the potential of AI for finance teams with clean data.

Amazing product with slick UI/UX. Its customers love it and they have high NPS.

Building the next generation ERP for finance is notoriously hard, but if you crack it the rewards are even higher, potentially one of the largest categories within software. We are convinced Nic, Stelios and the amazing team at Rillet will do so.

Peter with Nicolas Kopp, CEO of Rillet